Mortgage Calculator: PMI, Taxes & More

Table Of Content

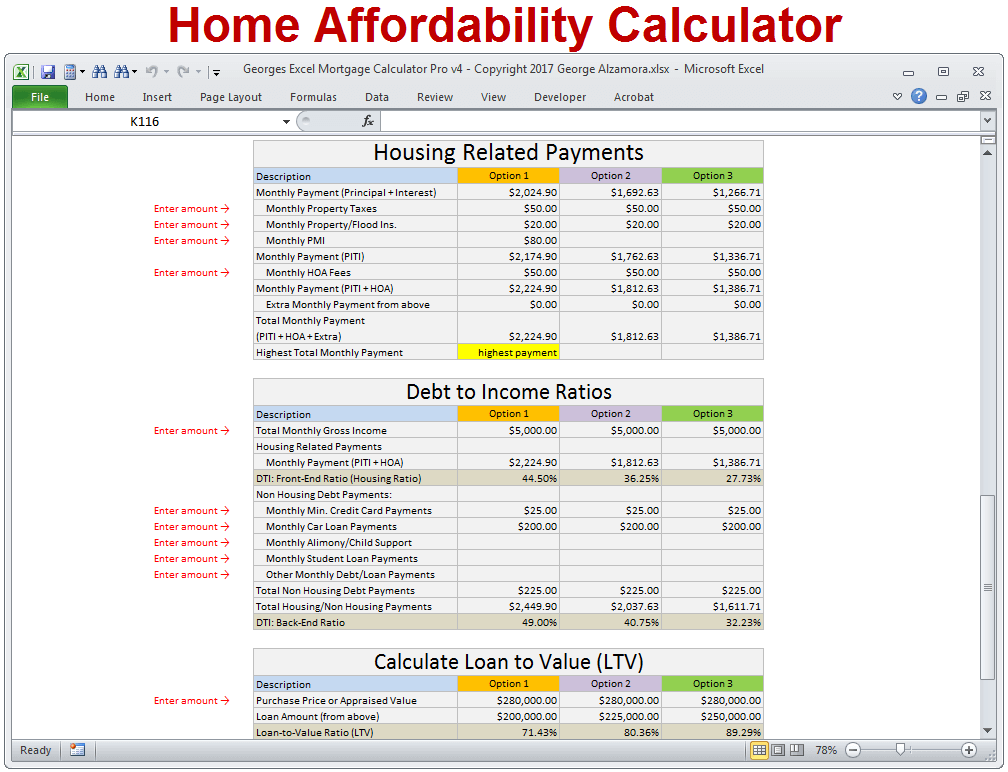

While 43% is the highest DTI that borrowers can typically have and still qualify for a conventional mortgage, most lenders prefer borrowers with a back-end ratio of 36% or lower. In general, mortgage approvals require a debt-to-income of 45% or less, although lenders will sometimes allow for an exception. Note, though, that your monthly obligation on a credit card is its minimum payment due and not your total balance owed. For credit cards with no minimum payment due, use 5% of your balance owed as your minimum payment due.

How much house can I afford with an FHA loan?

Only a lender can tell you for sure whether you’re mortgage eligible. We'll send you disclosures listing your loan terms as well as estimated payments, and your application will be reviewed by an underwriter. Equally, the lower the interest rate you can get the less you’ll pay each month against your mortgage as well as over the life of the loan. Below are some hypothetical examples of how slight differences in your APR(%) can impact what you pay against your mortgage. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender.

How PITI affects your mortgage qualification

With FHA loans, mortgage insurance is called mortgage insurance premium (MIP). Laws vary by state but, as a general rule, your homeowners insurance policy must be big enough to cover the cost of rebuilding your home as-is. You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation. A report made by a qualified person to estimate the value of a property, often used to help determine an appropriate loan limit.

Typical costs included in a mortgage payment

On top of that bill, you’ll have to consider property taxes and homeowners insurance as two more recurring expenses. Take account of your financial readiness to buy a house by applying the 28/36 rule. Lenders generally want to see that when you add up your principal, interest, taxes and insurance, it totals less than 28% of your gross monthly income. Lenders also generally want to see that those housing costs plus other debt (i.e. auto loans) are less than 36% of your gross monthly income. The Federal Housing Administration (FHA) is an agency of the U.S. government. An FHA loan is a mortgage loan that is issued by banks and other commercial lenders but guaranteed by the FHA against a borrower’s default.

How much of my income should go towards paying a mortgage?

For instance, you may pay a higher premium for a home that’s older or hasn’t been properly maintained. When using a mortgage loan calculator, you’ll need to enter your zip code to receive an accurate estimate. Learning about lenders’ mortgage requirements can help you determine which homes are realistic options for you.

Our affordable lending options, including FHA loans and VA loans, help make homeownership possible. Check out our affordability calculator, and look for homebuyer grants in your area. Visit our mortgage education center for helpful tips and information. And from applying for a loan to managing your mortgage, Chase MyHome has you covered. Lenders care about your debt-to-income ratio because research shows that people with higher DTI ratios are less likely to keep up with their loan payments.

Other Financial Considerations

Home Affordability Calculator - Zing! Blog by Quicken Loans

Home Affordability Calculator.

Posted: Fri, 25 Aug 2017 02:34:17 GMT [source]

Eligible active duty or retired service members, or their spouses, might qualify for down payment–free mortgages from the U.S. These loans have competitive mortgage rates, and they don't require PMI, even if you put less than 20 percent down. Plus, there is no limit on the amount you can borrow if you’re a first-time homebuyer with full entitlement.

The lower the DTI, the more likely a home-buyer is to get a good deal. Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our experts have been helping you master your money for over four decades.

As a home buyer, you’ll want to have a certain level of comfort in understanding your monthly mortgage payments. See our current mortgage rates, low down payment options, and jumbo mortgage loans. Along with property taxes, homeowners insurance can be paid in equal installments along with your monthly mortgage payment.

Credit scores in the calculator are used just to determine private mortgage insurance costs. But lenders use credit scores to set interest rates as well, so your rate may be higher or lower than shown here. Our Closing Costs Study assumed a 30-year fixed-rate mortgage with a 20% down payment on each county’s median home value. We considered all applicable closing costs, including the mortgage tax, transfer tax and both fixed and variable fees. Once we calculated the typical closing costs in each county we divided that figure by the county’s median home value to find the closing costs as a percentage of home value figure. A mortgage calculator can help you get a realistic idea of the type of home you can afford.

If you want to explore an FHA loan further, use our FHA mortgage calculator for more details. Exactly how much you qualify for will depend on your individual circumstances, including credit score, current interest rates and how much you’ll have in savings after you buy a home. You won’t have to worry about mortgage tax, as California does not charge buyers for purchasing a home, like New York does.

The home affordability calculator provides you with an appropriate price range based on your input. Most importantly, it takes into account all of your monthly obligations to determine if a home could be comfortably within financial reach. That’s a big deal, because mortgages backed by the Department of Veterans Affairs typically don’t require a down payment.

Amy Fontinelle is a freelance writer, researcher and editor who brings a journalistic approach to personal finance content. Amy also has extensive experience editing academic papers and articles by professional economists, including eight years as the production manager of an economics journal. Once again, the answer to this question will depend on where you want to buy and what kind of property you want. Your credit score and DTI will also be important factors in determining what interest rate and loan terms you get from the lender. Home maintenance will cost money, and the larger and older the home, the more upkeep you’ll have to budget for. In a shared building, the HOA might take care of most maintenance.

Comments

Post a Comment